If you fail to file the IRS 4868 form, you may be subject to penalties and interest on any unpaid tax liability.

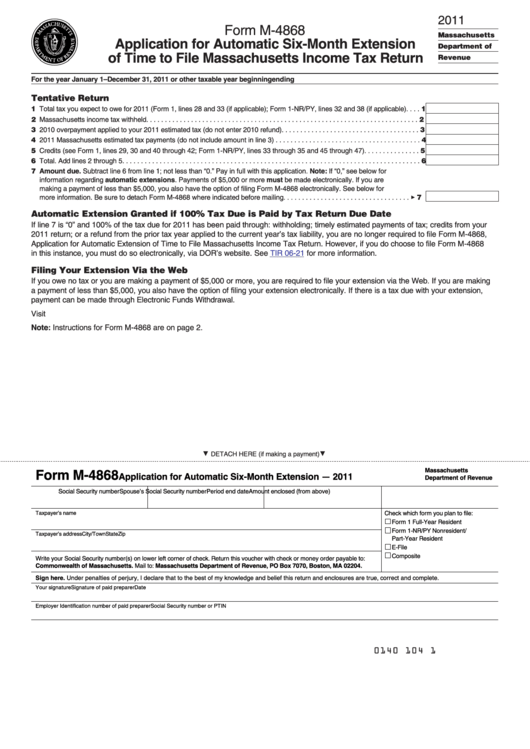

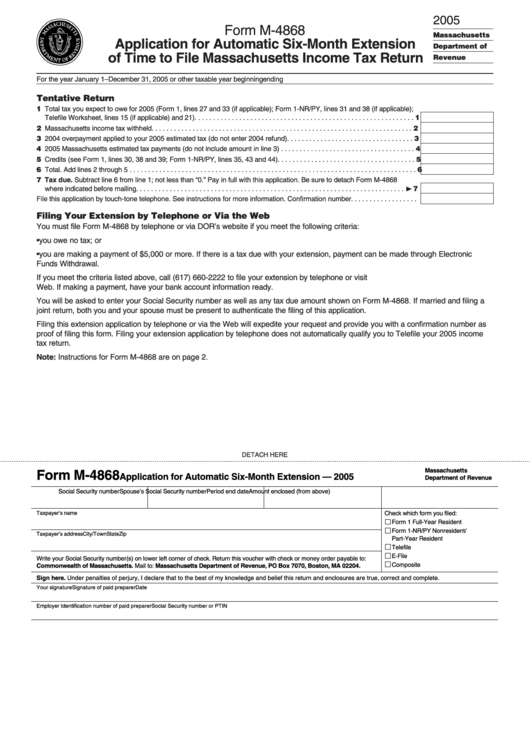

Additionally, you will need to make a payment of any estimated tax liability you owe. You can use the IRS 1040 form to estimate your tax liability. You must provide your name, address, social security number, and an estimate of your total tax liability for the year. This form is important because it can give you an additional six months to file your tax return, which can be helpful if you need more time to gather your tax information or if you need to file an amended return.

The IRS 4868 form is an application for an automatic extension of time to file individual income tax returns.

0 kommentar(er)

0 kommentar(er)